Live Webinar

Live Webinar - ESG for AEC: Does it Change How We Approach Green Building?

THIS WEBINAR PURCHASE AND REGISTRATION IS CLOSED

Thursday, October 13

Environmental, social, and governance (ESG) reporting is an increasingly common expectation throughout financial sectors, and the real estate industry is no exception.

This live webinar with our friend Chris Pyke, Ph.D., a senior vice president with Arc Skoru, lays the groundwork with three important facts:

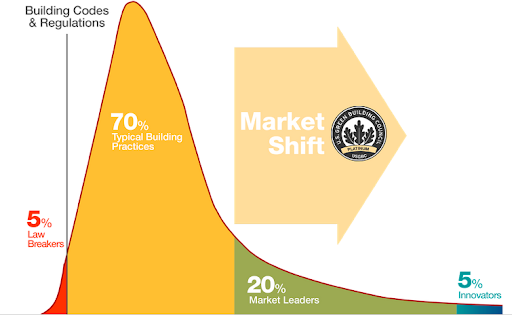

- Markets fail because of the lack of non-financial information.

- Market failure is the inefficient allocation of goods and services.

- ESG & Sustainable Finance are strategies to address market failure.

From there, we get deeper into the relationship between green building and ESG, ultimately understanding how green building and corporate ESG work together to drive positive change and value creation.

Here's your opportunity to learn:

- How ESG impacts roles & responsibilities

- 5 different ESG reporting systems—their distinctions and expectations

- The concept of materiality, including the implications of differences in definitions for client expectations and requirements

- Opportunities for green building strategies & certification to create value and improve ESG reporting

- How real estate company Prologis integrates green building and ESG with one another at all levels of the business and how green bonds have helped the company fund sustainable building projects

But can we go further, driving regenerative design through ESG?

The webinar analyzes multiple opportunities and barriers, concluding with an examination of the synergies and distinctions between ESG and green building.

Instructor: Chris Pyke

Course Level: Intermediate

1 AIA HSW, 1 GBCI Credit

-

Describe how ESG impacts the roles and responsibilities of design and construction teams working on green building projects.

-

List 5 different ESG reporting systems and explain their distinctions and expectations.

-

Explain the concept of materiality, including the implications of differences in definitions for client expectations and requirements.

-

Identify opportunities for green building strategies and certification to create value and improve ESG reporting.